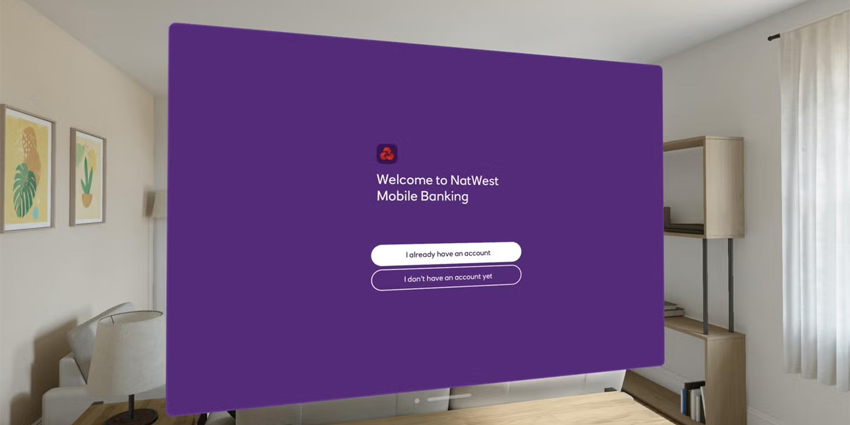

UK bank NatWest has announced that its retail banking app is now available on Apple’s Vision Pro.

The launch makes it one of the first banks globally to feature on Apple’s VisionOS, NatWest said, marking a significant step in the adoption of spatial computing in the financial services sector.

Wendy Redshaw, Chief Digital Information Officer at NatWest Group, said: “It’s great to be a first-mover with such exciting new technology.

“We’re very pleased to now offer our excellent retail banking app through an immersive new experience.

“It will be interesting to take learnings, understanding how customers use the app in this new technology to deal with their finances, and to understand how we can create bespoke propositions to serve them even better. It’s just one insight into how the future of banking could look in the future – watch this space.”

The bank said it had optimised the app specifically for the Vision Pro, particularly focusing on eye tracking and security measures to ensure safe banking on the new device.

The Vision Pro, recently launched in the UK, operates on VisionOS and includes a three-dimensional user interface controlled by eye movements, hand gestures, and voice commands.

Users can interact with the NatWest app by looking at options, tapping their fingers to select, flicking their wrist to scroll, or using virtual keyboards and dictation for typing.

The app allows customers to perform typical banking tasks such as viewing balances, transferring funds, and managing direct debits in an immersive and secure environment.

Users can view their credit scores, manage spending and explore financial insights on a large, virtually limitless canvas. Cora+, NatWest’s Generative AI assistant, is also built into the app.

XR in Financial Services

A recent survey by HTC VIVE highlighted the increasing integration of extended reality (XR) in the financial sector. According to the study, 92% of financial professionals reported a positive return on investment (ROI) from XR technologies. Additionally, 82% believe their firms will adopt XR within the next five years.

The report showed that XR significantly impacts workforce skill development, with 84% of respondents noting improvements due to XR-based training programs.

Elsewhere, 80% believe XR enhances overall operational efficiency. Customer experience also benefits from XR, with 77% indicating that it has improved the buyer’s journey. Furthermore, 59% of professionals find that 3D data visualisation through XR aids in better comprehension and decision-making processes.

Despite these benefits, security remains a critical concern. The financial industry deals with vast amounts of sensitive data, necessitating robust security measures for XR implementations.

Dan O’Brien, HTC VIVE’s President of Americas, emphasised the importance of deep regulations and stringent security protocols to protect consumer, worker, and business data.

He said that XR technologies must be designed with enterprise-level security from the outset to mitigate risks and ensure safe adoption in the financial sector.