Legislators in the European Union have reached a “provisional” agreement for its long-awaited European Chips Act, it was announced on Tuesday.

The Swedish Presidency announced in a tweet that the Act aimed to scale up Europe’s tech ecosystem, allowing the 27-member bloc of nations to increase competitiveness in global markets.

#TRILOGUE | @EUCouncil & @Europarl_EN negotiators have reached a provisional political agreement on the European Chips Act.

The Chips Act will boost the European ecosystem for semiconductors and play a vital part in strengthening the EU’s competitiveness at the global level. pic.twitter.com/kBUrj5Fm2B

— Swedish Presidency of the Council of the EU (@sweden2023eu) April 18, 2023

In a tweet, the Presidency said,

“[EU Council and European Parliament] negotiators have reached a provisional political agreement on the European Chips Act. The Chips Act will boost the European ecosystem for semiconductors and play a vital part in strengthening the EU’s competitiveness at the global level”

Ursula von der Leyen, President of the European Commission, noted the deal will provide €15 billion in investments for Europe’s semiconductor industry. The EU will provide the funds from Tuesday to 2030 to allow Europe to become an “industrial leader” in the global economy.

Euro Chipmakers to Challenge Tech Hegemony?

The news comes after the European Union created its semiconductor plan valued at 43 billion euros to challenge the United States and Asia, Reuters reported in early April, citing sources with direct knowledge of the matter.

Last year, the European Commission revealed plans to reduce dependence on the US and Asia after shortages hit global supply chains. Businesses affected included automotive firms, manufacturers, and computing devices.

Brussels aims to double its share of global production to around 20 percent as the United States launched its own iteration to compete with Asia. The US CHIPS Act aims to boost Washington’s chip capacity amid massive shortages in supply lines and the ongoing US-China trade war.

EU legislators met in Strasbourg for a monthly European Parliamentary session to discuss funding for the Act. The bill faced shortfalls in funding, totalling 400 million euros, but lawmakers have currently resolved the matter.

Other issues included distributing value chains across smaller EU member states. This triggered several countries after Intel selected Germany to host its chipmaking fab plant.

The EU boosted funds in negotiations by leveraging Belgian nanoelectronics giant IMEC and French-Italian tech company STMicroelectronics. Reuters concluded that the latter recently partnered with GlobalFoundries to create a massive chipmaking plant in France with government funds, with the facility valued at 6.7 billion euros.

US CHIPS Act, Tech Shortages

The developments come after the US Congress approved the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act in October last year.

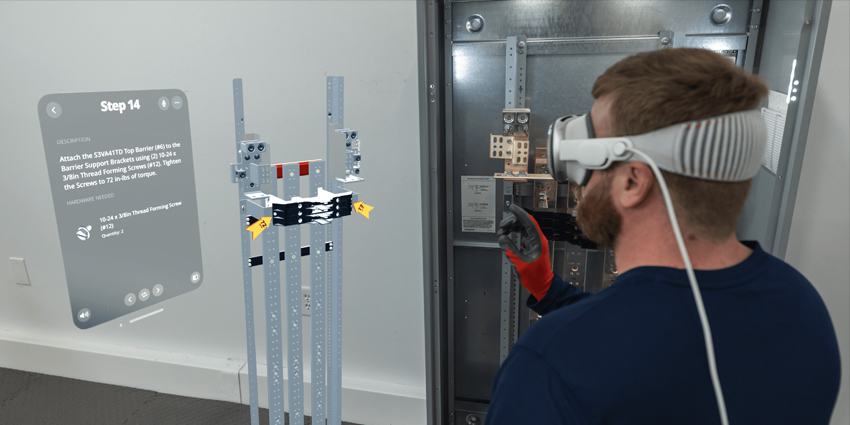

The XR Association, an organisation dedicated to facilitating the virtual, augmented, mixed, and extended reality (VR/AR/MR/XR) industry, praised the watershed bill at the time. The deal will allocate a part of $250 million USD to develop the nation’s XR technological capabilities.

US President Joe Biden later signed off on the Act, approving the measures to boost the nation’s semiconductor production.

At the time, Joan O’Hara, Vice President of Public Policy, XRA said in a statement:

“The XR Association worked closely with members of the Congressional Reality Caucus and other lawmakers to ensure XR technology was properly recognized as a significant technology of the future, and that it will be supported through important research and development opportunities.”

XR headsets, components, Internet of Things (IoT) devices, and other critical tools remain key to building and developing the devices needed to create the Metaverse. Global organisations across the US, China, and EU have now begun backing their industries to ensure sufficient access to critical chips needed to secure manufacturing.

Companies such as Apple have been hit hardest by ongoing component shortages amid the COVID-19 pandemic. Shipments in 2022 nosedived 40 percent due to the looming economic recession, chip shortages, and other issues.

Facilities in China producing Apple’s components, including Foxconn, shut their doors intermittently after facing outbreaks over the last few years, prompting government crackdowns on the spread of the disease.

Meteoric rises in the demand for electronics also severely disrupted stocks of devices and placed immense pressure on chipset availability, causing plants to cease production temporarily.